総合型選抜(AO入試) 部活やってない

「総合型選抜(AO入試)は部活をやってないと不利なのか?」

「活動報告書に何を書けば良いか分からない」

といった悩みはありませんか?

他にも

総合型選抜(AO入試)の受験は、一人ひとり必要な対策が違います。

そのため、どんな対策をすれば良いか分からず不安になりますよね。

私も総合型選抜を受けた経験があるのですが、部活動やボランティアなどを全くしていなかったので自己アピールの仕方で悩んでいました。

また、小論文や志望理由書の書き方、面接の対策なども分からなかったので不安になる気持ちはよく分かります。

私の場合は、最初は高校の先生の指導だけでできると思い参考書片手にやっていました。

しかし高校の先生は一般入試の対策だけで手一杯で、総合型選抜まで手が回らないようで具体的な対策がほとんどありませんでした。

一般入試を受ける人の方が圧倒的に多いので、ほとんどの高校が同じような状態だと思います。

やはり客観的に見て指導してくれる人がいないと、総合型選抜の正しい対策をすることはできません。

そこでこの記事では、総合型選抜に合格するためにどんな対策をすれば良いのかを紹介します。

実際に毎年多くの人が総合型選抜に合格している方法なので、対策方法が分からないという人に役立つと思います。

ぜひ最後まで読んでみて下さい。

総合型選抜で活動実績をアピールする際に、高校での部活の実績は有利に働きます。

しかし、部活動をしていたからといってそれだけで総合型選抜に合格するものではありません。

総合型選抜は大学が求める学生像に合っているかを見極める入試形態です。

必ずしも部活等で実績があることを求めているわけではないからです。

ですから部活をしていないことが特別に不利になることはありません。

部活以外の課外活動などでアピールすれば良いのです。

部活以外にも様々な活動があるので、自分がどのような活動をしてきたか自己アピールできれば合格することが可能です。

活動報告書に書く内容はよく考える必要があります。

ただ事実を列挙しただけでは高い評価は得られないでしょう。

またそれらの活動だけでなく、小論文や面接などで大学側が求めている学生像に合っていると評価されることも重要です。

何も対策をせず小論文や面接に臨むと不合格になる可能性があります。

活動報告書で評価されるのは部活だけではありません。

例えば次のようなものも評価されます。

上記以外のものでも上手く自己アピールできるように書くことで評価の対象となります。

ではどのように書けば良いかというと、ただ事実を列挙するだけでは高い評価は得られません。

例えば、「その活動を通してどんなことを考えたか」

「どのように成長できたか」

「これからどうしたいか」

といったことを書くと良いでしょう。

また、それらの内容を大学が求めている学生像に合うように上手くまとめることも大切です。

そして活動報告書を下書きしたら第三者に読んでもらい、おかしなところがないか添削してもらいましょう。

自分では上手く書けたと思っていても、独りよがりの内容になっていることが多々あるからです。

ただし、高校の先生は大学側がどんな学生像の人物を求めているかまでは分からないので、先生に添削してもらったらそれで十分とは限りません。

総合型選抜は学力だけでなく人間性・学習意欲・課外活動などを重視し、大学が求める学生像に合っているか見極められる入試形態です。

どのような点をアピールするかは受験生一人ひとり異り、自分に合った対策を立てることが重要になります。

そのため誰にでも当てはまるような、これをやれば良いという明確な対策がありません。

また大学や学部毎に試験内容やどんな点が重視されるかが異なるため、志望校の総合型選抜について詳しく調べて対策する必要があります。

しかし高校では一般入試を受ける生徒の方が圧倒的に多いのでそちらの対策にかかりきりになり、総合型選抜の対策まで手が回りません。

これらのことから、高校での対策だけでは不十分なことがほとんどです。

そこで、私が利用したのは総合型選抜(AO入試)専門の対策塾でした。

一般的な受験塾や予備校と異なり、小論文や志望理由書の書き方など総合型選抜の試験内容に特化して対策を行ってくれる塾です。

学校別に対策してくれるので、志望校合格へ向かって大きく前進できます。

また、課外活動(部活や生徒会、ボランティアなど)の実績がなくてアピールすることもないという人でも、一人ひとりの背景に合ったアピールの仕方を対策してくれます。

それぞれの大学や学部の総合型選抜にも詳しいので、活動報告書がその大学を受けるのに相応しい内容になっているかも添削してもらえます。

何も対策しないで総合型選抜(AO入試)を受けるのと、専門塾でしっかり対策をしてから試験に臨むとでは雲泥の差です。

総合型選抜専門塾を利用し始めてから、

活動報告書や志望理由書の書き方はもちろんのこと、

小論文や面接の対策も万全に!

自分が将来何をしたいかしっかり考えることができるようになり、

入試の面接でも自信をもってアピールすることができました。

今では希望の大学に受かり、自分の夢につながる勉強が出来て毎日楽しいキャンパスライフを送っています。

総合型選抜専門の塾に通っていて本当に良かったと感じています。

ここでは、特におすすめの総合型選抜専門対策塾を厳選して紹介します。

総合型選抜専門対策塾を選ぶ際のポイントを満たすところがおすすめです。

これらのポイントを押さえておけば、塾選びに失敗することはなくなります。

難関大学総合型選抜(AO入試)対策の大手塾。

志望校合格率87.2%という高い合格率を出し続けています。

特に早慶上智への合格実績が多数あり、2022年度の慶應義塾大学の合格者は124名です。

ルークス私塾も無料相談を行っているので、相談してから入塾するか判断すると良いでしょう。

無料相談は校舎とオンラインのどちらでも受けられます。

| 対象 | 中学生・高校1~3年生・既卒 |

|---|---|

| 授業料 | 平均40万円(年間)、月額76,780円 |

| 授業形態 | 集団 |

| 対応入試形態 | 総合選抜型・AO推薦入試・一般入試 |

| 教室 | 首都圏11教室(代々木、四谷、池袋、目黒、自由が丘、下北沢、町田、吉祥寺、横浜、青葉台、柏) |

※画像引用:公式サイト

東進ネットワークに所属する学習塾。

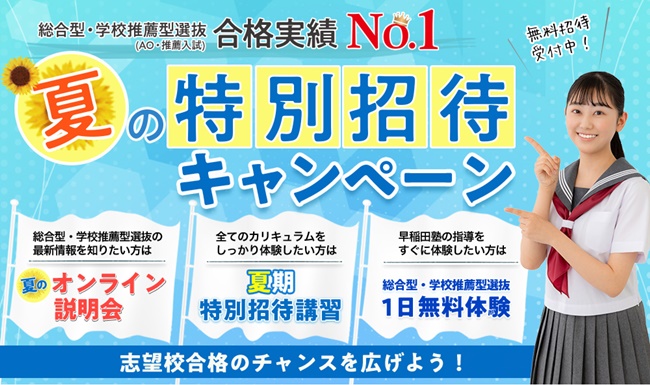

一般入試対策を行っている中、コースの1つとして、「総合型・学校推薦型選抜(AO・推薦入試)特別指導」コースが設置されている。

一人一人の志望大学に合わせたオリジナル出願戦略を提案。大学ごとの様々な入試形態に対応し指導。

| 対象 | 高校2~3年生 |

|---|---|

| 授業料 | 非公表 |

| 授業形態 | 集団 |

| 対応入試形態 | 総合選抜型・AO推薦入試・一般入試 |

| 教室 | 12教室(池袋、大崎、自由が丘、新宿、四谷、吉祥寺、町田、青葉台、藤沢、横浜、柏、津田沼) |

AOIは業界No.1の合格率を誇る総合型選抜(AO入試)専門塾。2022年の合格率は95.2%です。

関東・関西に4校舎を展開しています。オンライン校もあるので地方や海外在住の学生の対応も可能。

高い合格率がありながら、授業料が他社と比べてリーズナブルなので人気です。

標準的な授業料は年間48万円~となっていますが、必要なコマ数が少ない場合にはこれよりも安くなります。

AOIでは1時間の無料カウンセリングを行っています。「塾に通うべきか」「どの塾が良いか」迷っている方はカウンセリングを受けてみると良いでしょう。

また入塾を検討されている場合でも、「自分が総合型選抜に向いているのか」「自分が合格するための具体的な対策方法」などが分かります。

無料カウンセリングを受けて自分と合わないなと思ったら入塾する必要はないので気軽に受けてみてください。

| 対象 | 高校1~3年生・浪人生 |

|---|---|

| 授業料 | 48万円~(年間) |

| 授業形態 | 個別 |

| 対応入試形態 | 総合選抜型・AO推薦入試 |

| 教室 | オンライン校、渋谷校、大阪校、京都校、西宮北口校 |

「ルークス志塾」は総合型選抜・推薦入試に特化した専門塾です。

難関国立・私立大学の総合型選抜・推薦入試への高い合格率を誇ります。

11校舎を展開し、オンライン校もあるので地方在住で近くに総合型選抜の専門塾がないという方でも利用できます。

高い合格率がありながら、授業料が他社と比べてリーズナブルなので人気があります。

デメリットは独学で対策するのに比べると授業料がかかることです。

しかし、平均的な総合型選抜の対策塾と比べると授業料は3分の1程です。

比較的リーズナブルな授業料で志望校への合格率が高まります。

もう1つのデメリットとして、オンライン授業は基本的に個別指導となることが挙げられます。

そのため、集団授業が良いという方には向かないかもしれません。

ルークス志塾を利用するメリットをまとめました。

対策を始めるのが遅くなるとどうしてもあせってしまい、受験当日に緊張で実力を発揮できないことも考えられます。

対策するなら早ければ早いほど受験日に合わせてしっかりと実力をつけることが可能です。

早い人は3年生になる前から対策して、狙いすましたように合格を勝ち取ります。

もちろん対策を始めるのが遅いからと言って、合格できないわけではありません。

一番重要なのは、志望校に合った正しい対策をすることです。

例えば、目的地へ向かうときに間違った地図を見ていたら、目的地にたどり着くどころか反対方向へ進んでしまうかもしれません。

総合型選抜の場合も同じように、正しい対策をしなければ合格へたどり着くのが難しくなります。

正しい対策をすることで遅れを一気に取り戻すことも可能です。

そのためにも総合型選抜の合格率が高い専門塾がきっと役に立つでしょう。

\総合型選抜の合格率が高い/ ルークス志塾の公式サイトはこちら

上記でも説明しましたが、総合型選抜専門塾を選ぶポイントは次の5つです。

これらのポイントについて詳しく紹介します。

志望校合格のためには、やはり合格実績が十分になるかは確認すべき事項になります。

特に自分が行きたい特定大学がある場合は、その大学への合格実績が高い塾で学習する方が、合格するにはより有利になります。

学生に志望校に合わせたしっかり個別に指導してもらえるのかが重要です。1対1の個別授業を取り入れている塾を選ぶようにするとよいです。

総合型選抜対策といっても、自己分析、志望理由書、小論文、面接・プレゼン、英語資格などがあり、志望校に合わせて必要な対策も様々です。それぞれに合わせて特化した教材や授業がある塾を選ぶのもポイントです。

総合型選抜を受けるにあたって、自己分析をした上で志望校を決めるのも重要です。自分の将来の夢や強みについて、学生自身が相談しやすい環境がある塾を選ぶようにするとよいです。

特に、まだ志望校が決まっていない、活動実績を持っていない学生の場合、自分自身について相談しやすい塾であるのかは重要になります。

総合型選抜対策塾の多くは、高校生を対象としており、浪人生は受け入れてもらえないところがほとんどです。

浪人生の場合、時間の使い方によっては、総合型選抜でも有利になります。浪人生で総合型選抜を考えている学生は、浪人生も受け入れてもらえる塾を選びましょう。

総合型選抜対策塾おすすめ3選へAO入試は、高校生活や社会人経験を踏まえた個人の特性や学習能力を重視する入試方法であり、志望動機や自己PRなどが重要なポイントとなります。 しかし、AO入試で求められる活動実績は、単なるボランティア活動や部活動の参加だけでなく、自発的に学びを深めるための活動や、自己表現能力を磨くための活動など多岐にわたります。そのため、AO入試を受験する際には、自分自身がどのような価値観や人生観を持ち、何に興味があるかを明確にし、それに沿った活動実績を積むことが求められます。

AO入試を受験する志望者の中には、十分な活動実績を持っていない場合があります。その場合、自分に合った活動を見つけ、自己成長につながる経験を積むことが必要です。また、活動実績が少なくても、それを補うために、自己分析や勉強に取り組む姿勢をアピールすることも大切です。 AO入試を受験する際には、自分自身の強みや特色を生かした活動実績を積み、それを明確に自己PRにつなげることが求められます。また、活動実績が不足している場合には、自分自身の成長意欲や学習能力をアピールすることが必要です。

一般的に、大学側は志望者に対して、社会貢献や人間性の成長を促すために、ボランティア活動の経験を求める傾向があります。 しかし、ボランティア活動は、必ずしもAO入試において必須の要素ではありません。AO入試では、個人の特性や学習能力を重視するため、自己分析や自己表現能力を駆使して、自分自身の強みや特色をアピールすることが重要です。 もし、ボランティア活動の経験がない場合には、その理由や代替の活動などを明確にすることが大切です。たとえば、学業に専念していたためにボランティア活動をしていなかった場合には、自分自身の学習成果や学習意欲をアピールすることができます。また、趣味や特技などを生かした活動実績や、自発的に学びを深めるための取り組みを紹介することも有効です。 ボランティア活動ができなかったとしても、自分自身が持つ強みや特色を生かして、大学側にアピールすることが重要です。AO入試においては、志望者自身がどのような人物であるかを大学側が評価するため、自己分析や自己表現能力を駆使して、自分自身をアピールすることが求められます。

AO入試では、活動実績を通じて、社会貢献や人間性の成長を促すことができるだけでなく、個人の特性や学習能力を示すことが求められます。

活動実績の例としては、ボランティア活動、スポーツや文化活動、インターンシップや就業経験、留学や海外ボランティア、自主研究や研究発表などが挙げられます。これらの活動実績は、それぞれ異なる観点から志望者の能力や資質を示すことができます。

また、活動実績をアピールする際には、どのような成果を得たか、どのような課題に取り組んだか、どのような意義を感じたかなどを具体的に伝えることが重要です。さらに、その経験を通じて得た成長や学び、そして、大学でどのようなことに取り組みたいかという志望理由との関連性を示すことも大切です。 AO入試においては、志望者自身の個性や強みをアピールすることが求められます。活動実績は、そのための有力な手段の1つであり、自分自身がどのような人物であるかを大学側にアピールするための材料として積極的に活用していくことが大切です。

帰宅部とは、放課後に校内に残り、部活動に参加せずに自由行動をする生徒のことを指します。しかし、最近では、帰宅部でもさまざまな活動を行い、その成果をまとめた「活動報告書」を提出することが求められるようになってきています。

活動報告書は、自己表現力やコミュニケーション能力を育成することができるだけでなく、自分の成長や学びを振り返り、次のステップにつなげるための有効なツールとしても活用されます。帰宅部でも、学校や地域で行われるさまざまな活動に参加し、その成果を報告書としてまとめることができます。 例えば、帰宅部であっても、文化祭や運動会、校内で行われる講演会やイベントなどに参加し、実行委員会や運営スタッフとして協力したり、ボランティア活動に参加したりすることができます。また、自主的に読書や研究に取り組み、その成果を報告書としてまとめることもできます。

活動報告書は、帰宅部であっても、自己表現力やコミュニケーション能力を育成するために役立つものです。自分の成長や学びを振り返り、さらなる成長につなげるためにも、活動報告書の作成に積極的に取り組んでいくことが大切です。

総合型選抜は、大学入試において人物重視の選抜方法として注目を集めています。そのため、書類審査の重要性が高まっています。書類審査は、学力だけでなく、自己表現力や人物像を評価するための重要なステップです。 しかし、総合型選抜の書類審査で落ちるという結果を受け取ることもあります。その理由はさまざまですが、自己表現力が不十分だった、志望動機が十分に伝わらなかった、活動実績が不十分だったなどが考えられます。また、書類審査の時期に応募書類が不備などで届かなかった場合も、不合格になることがあります。

総合型選抜の書類審査に不合格になったからといって、全てが終わったわけではありません。一度落ちても、再度チャレンジすることができます。自己表現力や志望動機を改善するための努力や、さらに活動実績を積み重ねることで、次回の書類審査に合格することができるかもしれません。 総合型選抜の書類審査に不合格になったとしても、その結果を受け止め、今後の自分のために取り組んでいくことが大切です。再度チャレンジするために、不合格の理由を正確に把握し、改善点を明確にしていくことが必要です。